maryland student loan tax credit application 2021

A copy of your maryland income tax return for the most recent prior tax year. Since 2017 Marylands student loan debt relief tax credit has provided over 40 million to over 40000.

Comptroller Implores Marylanders To Apply For Student Loan Tax Credit Afro American Newspapers

Maryland taxpayers who have incurred at.

. The following documents are required to be included with your completed Student Loan Debt Relief Tax Credit Application. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at. I file an amended income tax return for the taxable year in which the qualified expenses were incurred.

And ii attach a copy of the Maryland. To be eligible for the tax credit Maryland residents must have incurred at least 20000 in student loan debt and have at least 5000 in outstanding student loan debt at. Credit for the repayment of eligible student loans.

Otherwise recipients may have to repay the credit. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. To claim the credit an individual shall.

Instructions are at the end of this application. If you live in Maryland you have only days left to apply for a tax credit to cover some of your student loans. The state is offering up to 1000.

Complete transcripts from each undergraduate. How to apply for Marylands student loan debt relief tax credit. 2021 Update Canadian Debt Consolidation Plan.

Complete the student loan debt relief tax credit application. September 14 2022 757 pm. Note that you must include a copy of.

Going to college may seem out of. To apply you must submit an application to the Maryland Higher Education Commission by September 15 2021. How Do I Apply.

More than 40000 Marylanders have benefited from the tax credit. The site outlined that in 2021 close to 9000 residents of Maryland. For Maryland Residents or Part-year Residents Tax Year 2020 Only.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are. Student Loan Debt Relief Tax Credit Application. At the bottom of the page you will find a heading called apply or.

23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan Debt Relief Tax Credit by Sept. When the student is awarded with.

State Individual Income Tax Rates And Brackets Tax Foundation

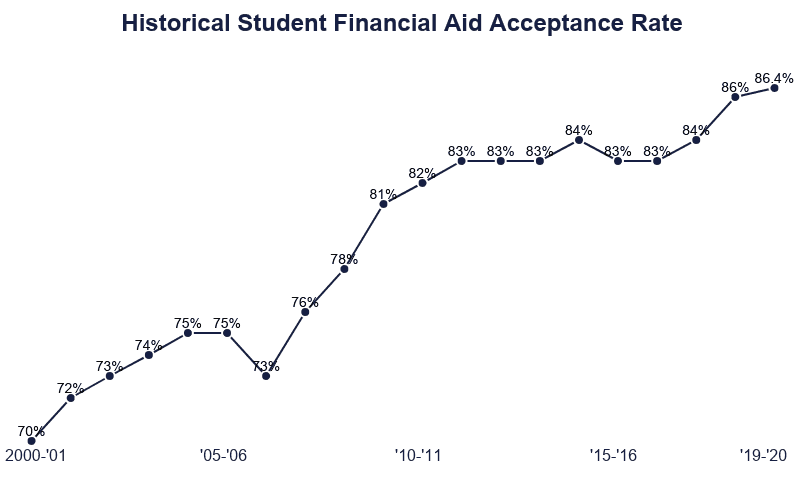

Financial Aid Statistics 2022 Average Aid Per Student

2022 State Tax Reform State Tax Relief Rebate Checks

2020 Unemployment Tax Break H R Block

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Maryland Department Of Commerce 2021 Annual Report By State Of Maryland Issuu

The Elm Maryland Student Debt Relief Tax Credit Apply By Sept 15

Maryland Student Loan Forgiveness Programs

79 000 Families In Maryland Eligible For Child Tax Credit

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Moco Show

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit Cbs Baltimore

11 Cities And States That Help Pay Off Your Student Loans Student Loan Planner

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

More Companies Are Helping Workers Pay Down Student Loans Money

Student Loan Debt Statistics In 2021 A Record 1 7 Trillion

Biden To Wipe Out 10 000 In Student Loan Debt For Many Borrowers Maryland Matters

State Taxes And Student Loan Forgiveness Ibr Pslf And More

Income Recertification Planning As Student Loan Freezes Ends

Will Borrowers Have To Pay State Income Tax On Forgiven Student Loans Wolters Kluwer